Marketplace facilitators like DoorDash connect buyers with sellers. When merchants sell goods on the DoorDash platform, they may be required to collect and remit tax on those orders. Some jurisdictions have tax laws that shift certain tax remittance responsibilities from merchants to DoorDash. These marketplace facilitator laws affect how taxes are handled on the platform and how merchants payouts are calculated. In the article below, we’ll walk through specifics on the marketplace facilitator rules, the jurisdictions they relate to, and what this means for merchant tax reporting obligations.

What is a marketplace facilitator?

In general terms, a marketplace facilitator is a platform like DoorDash that connects buyers and sellers to help facilitate the sale of various goods and services, including food, drinks, groceries, and other retail items.

How do marketplace facilitator laws impact tax?

In some jurisdictions, there are laws that change the party that is responsible for remitting tax on sales made between buyers and sellers on a marketplace facilitator’s platform. These laws shift the responsibility of tax remittance from merchants to DoorDash, as the marketplace facilitator. In these jurisdictions, listed below, DoorDash remits directly to the tax authorities certain taxes on the merchant’s sales made through the DoorDash platform.

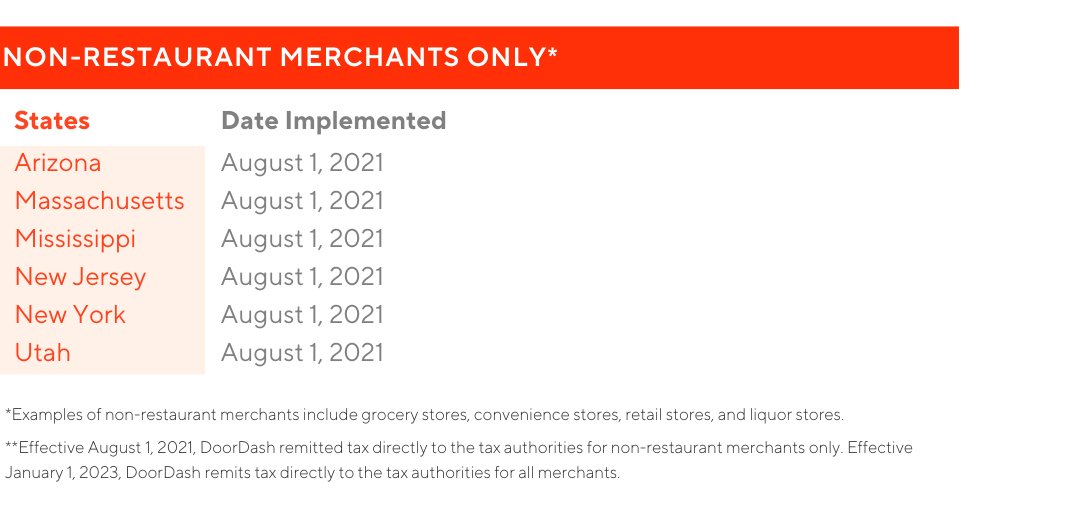

In which jurisdictions does DoorDash remit tax directly to the tax authorities as a marketplace facilitator?

DoorDash is registered to collect and remit certain taxes directly to the tax authorities as a marketplace facilitator on orders made through the DoorDash platform in the following jurisdictions:

Marketplace Facilitator List

How does DoorDash handle local taxes in marketplace facilitator states?

Historically, DoorDash has remitted all applicable local taxes, such as food and beverage taxes imposed by counties and cities, directly to tax authorities in states where DoorDash is a marketplace facilitator. The only exception has been in Alabama and Florida, where, starting May 1, 2024, DoorDash began passing certain local taxes through to restaurant merchants rather than remitting them directly to the tax authorities.

Starting July 1, 2025, in all states where DoorDash acts as a marketplace facilitator, DoorDash will include certain local taxes in payouts to non-integrated restaurants instead of remitting them directly to tax authorities. Here’s what the means:

DoorDash will continue to collect all applicable taxes from customers at checkout.

DoorDash will continue to remit certain taxes (typically state-level sales taxes) directly to tax authorities.

DoorDash will pass through certain local taxes (typically food and beverage taxes) to non-integrated restaurant merchants.

⚠️ Important: DoorDash will not remit to tax authorities any taxes that are passed through to merchants.

This change applies only to:

Non-integrated restaurant merchants (i.e., those not connected through a POS integration)

This change does not apply to:

Integrated restaurant merchants (connected through a POS integration)

Non-restaurant merchants (e.g., grocery, retail, liquor)

How do the marketplace facilitator laws affect my payouts?

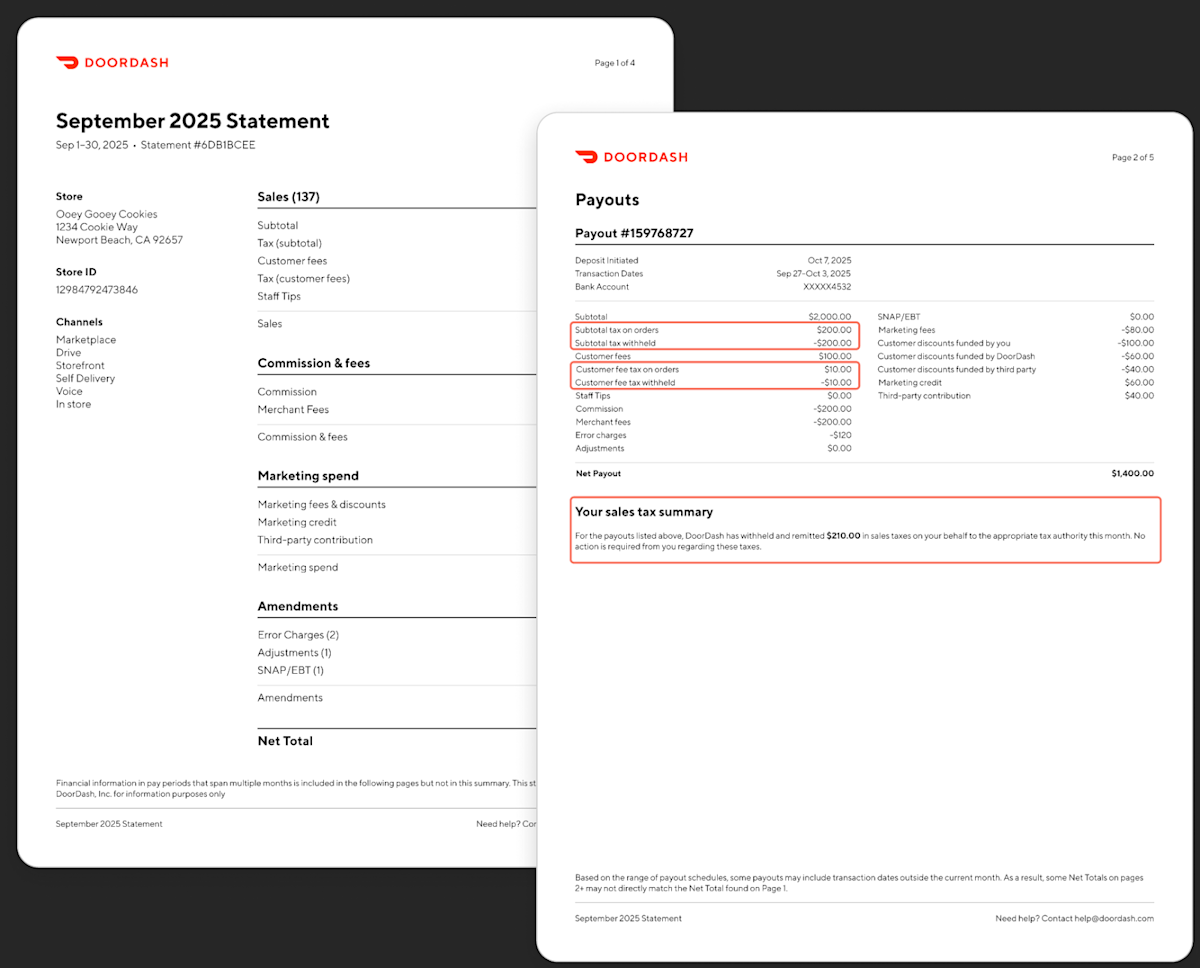

Merchant payouts will include any taxes that DoorDash collects but does not remit directly to the tax authorities. Merchant payouts will exclude any taxes that DoorDash collects and remits directly to tax authorities.

For details on which taxes DoorDash remits and which are passed through to the merchant, see the sections above.

Where can I view the tax that DoorDash remitted directly to the tax authorities for my orders?

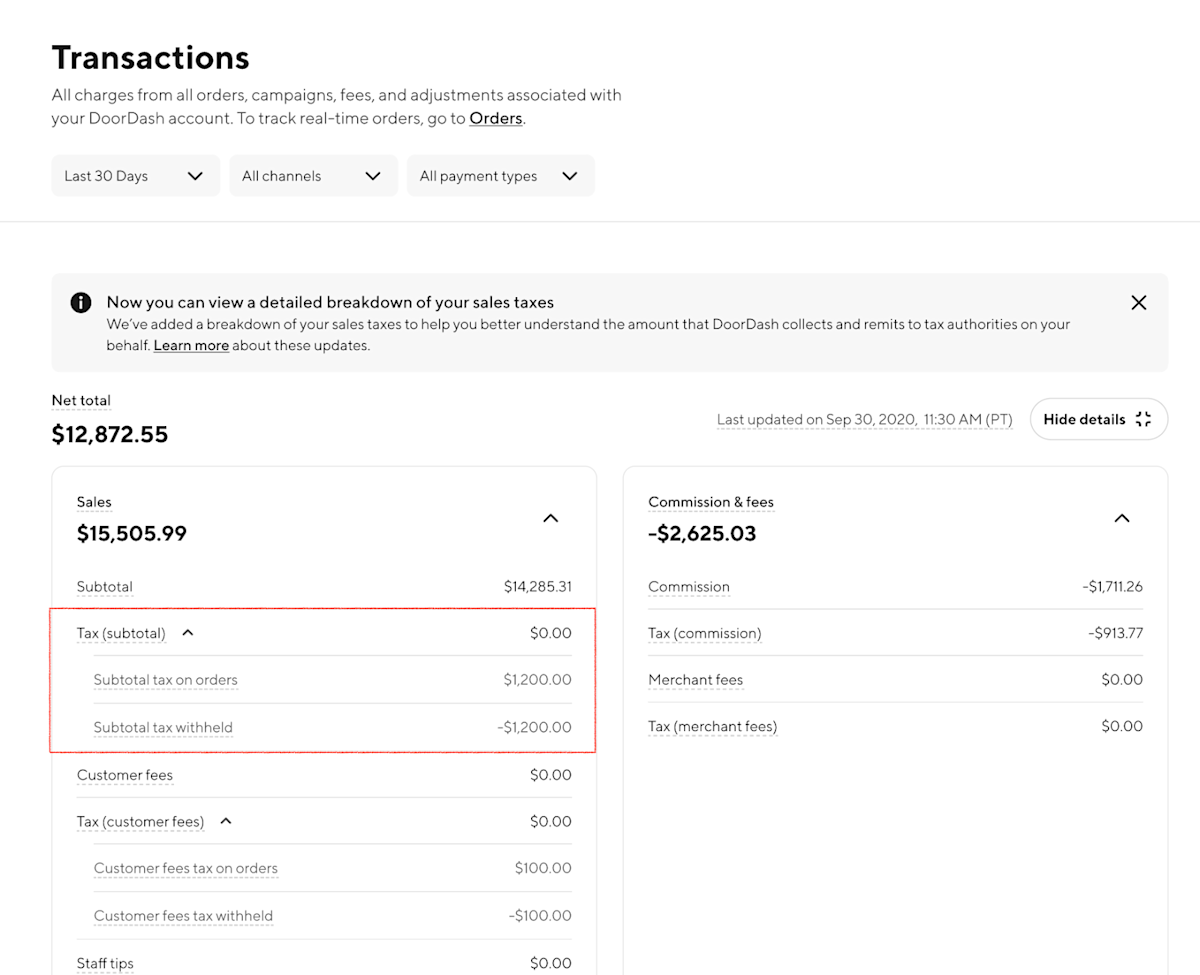

Merchants can view the tax that DoorDash remitted directly to the tax authorities in various reports available in the Merchant Portal.

To view the tax that DoorDash remitted directly to the tax authorities for each order, see the Transactions breakdown report, column “Subtotal Tax Remitted by DoorDash to Tax Authorities”.

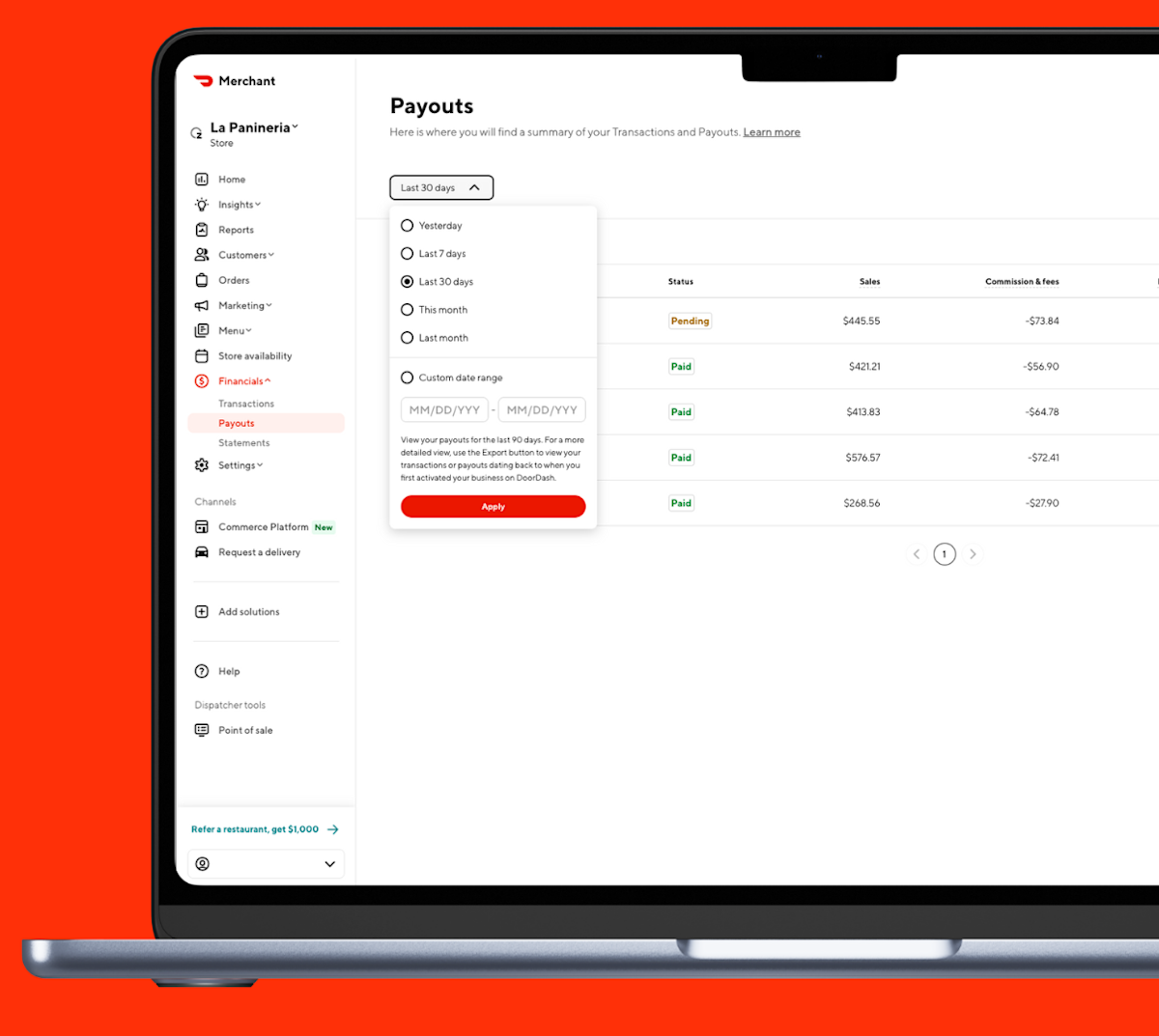

To view the tax that DoorDash remitted directly to the tax authorities for each payout, see the Payouts report, column “Subtotal Tax Remitted by DoorDash to Tax Authorities”.

To view the tax that DoorDash remitted directly to the tax authorities for a selected period in the Transactions page in the Merchant Portal, see the Sales card as shown below.

To view the tax that DoorDash remitted directly to the tax authorities for a selected payout in the Payouts page in the Merchant Portal, similar in layout and content to the one shown above.

To view the tax that DoorDash remitted directly to the tax authorities for a specific month in the monthly Statement, see the footnote in the document as shown below.

Please see How to Utilize DoorDash Reporting to download Transactions and Payouts reports from the Merchant Portal.

Coming soon, DoorDash will offer enhanced reporting in the Merchant Portal to improve transparency around tax collection and remittance. This includes the above updates to the Merchant portal.

In addition merchants will see a new downloadable report titled “Monthly Subtotal Tax Breakdown” available under the Statements tab in the Merchant Portal. This report will be generated monthly and will provide detailed information for each tax collected by DoorDash on merchant orders:

Tax jurisdiction: This is the jurisdiction that imposes the tax that DoorDash collected. This can be a state, county, city, or other jurisdiction.

Tax imposition: This is the type of tax imposed that DoorDash collected. This can be a sales and use tax, a food and beverage tax, or other tax.

Remittance responsibility: This is the party responsible for remitting the tax to the tax authorities. This will be either DoorDash or Merchant.

Taxable basis: This is the sales amount to which the tax was applied.

Tax amount: This is the amount of tax that DoorDash collected.

Also coming soon, DoorDash will provide clearer monthly statements which clarify which party is responsible for remitting subtotal tax to the tax authorities.

For which orders will DoorDash collect and remit tax directly to the tax authorities as a marketplace facilitator?

In jurisdictions where DoorDash is required to collect and remit tax as a marketplace facilitator, DoorDash will collect and remit certain taxes directly to the tax authorities on applicable sales facilitated in the jurisdictions listed above for Marketplace, Self-Delivery, Flexible Fulfillment, and Online Ordering. DoorDash does not collect and remit tax directly to the tax authorities for Drive On-Demand.

Who is responsible for setting tax rates on my menu items?

DoorDash is generally responsible for setting tax rates on merchant menu items in the jurisdictions in the Marketplace Facilitator List. Merchants are responsible for setting tax rates on merchant menu items in all other jurisdictions. For more information, head to How to Update the Tax Rates of Your Menu Items and Store.

How does the process differ for point-of-sale (POS) integrations?

There is no difference in tax payouts and tax remittance for POS integrations. DoorDash continues to handle all tax calculations where applicable. Merchants with POS integrations can access the Merchant Portal for reporting information. For more information, head to How to Update the Tax Rates of Your Menu Items and Store

What if I switch from a DoorDash tablet setup to a POS/Middleware integration after July 1, 2025?

If you transition from a DoorDash tablet (non-integrated) setup to a POS integration (such as Square, Toast, or Checkmate) after July 1, 2025, here is what to expect:

Your payouts will continue to include applicable local taxes

If your payouts included applicable local taxes after July 1, 2025, DoorDash will continue to include applicable local taxes (e.g., food and beverage taxes) in your payouts even after you switch to a POS integration. Your payout structure will not change as a result of a switch to a POS integration.

DoorDash remains the source of truth for tax payout reporting

If your POS integration is unable to receive and display local taxes, the tax reports generated by your POS system may not match the tax reports available in the DoorDash Merchant Portal.

To avoid reconciliation issues, rely on DoorDash’s Transactions and Payouts reports for accurate information about taxes collected and passed to you.

Can DoorDash send a letter to me confirming that DoorDash remits tax directly to the tax authorities for my store?

Yes, please contact DoorDash Merchant Support to submit a request.

How should I report my taxes?

DoorDash is unable to provide tax or legal advice. DoorDash recommends that merchants contact a tax professional.

Why don’t I see the Monthly Subtotal Tax Breakdown report in the Merchant Portal?

If the Monthly Subtotal Tax Breakdown report is not in the Merchant Portal, it means one of the following applies:

The merchant store is located in a jurisdiction where DoorDash is not a marketplace facilitator

DoorDash includes all taxes in the merchant’s payouts rather than remitting them directly to the tax authorities.

In these cases, DoorDash does not generate the Monthly Subtotal Tax Breakdown report.

What if I’m located in Puerto Rico?

As a marketplace facilitator, DoorDash remits tax directly to the tax authorities for all Puerto Rico merchants effective April 1, 2021. DoorDash’s Form SC 2918 “Certificado de Registro de Comerciante” is available here.

What if I’m located in Canada?

For information on the marketplace facilitator laws in Canada, please see the Marketplace Facilitator Guide for Canada.

What if I’m located in Australia or New Zealand?

Australia and New Zealand do not have marketplace facilitator laws that impact sales made through the DoorDash platform. Merchants in Australia and New Zealand are responsible for remitting all tax on sales made through the DoorDash platform.

Marketplace facilitator laws have changed the landscape of online sales, making platforms like DoorDash responsible for tax remittance in select jurisdictions. This shift has implications for merchant payouts and tax compliance, emphasizing the need for adaptability and awareness in the evolving e-commerce environment. This is why it’s important to speak with a tax professional to make sure you’re adhering to the current legal standards.

Still have questions?

If you have any questions, please submit a help ticket on the Merchant Portal.