Access financing with DoorDash Capital

Manage your business with fair and convenient financing.

Get started with DoorDashAlready on DoorDash? Log in to check eligibility.

How does it work?

Check eligibility

Opt in to data sharing in order to see if you have a pre-approved offer from Parafin in the Merchant Portal and verify your business information.

Customize terms

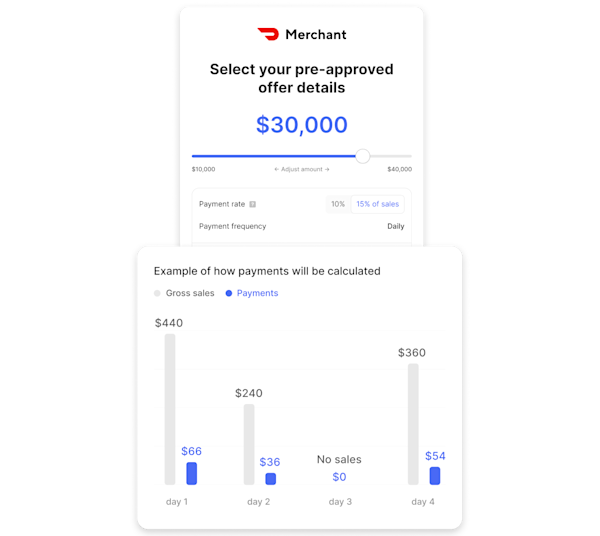

Choose your advance amount and payment rate.

Accept your offer

Agree to the terms of service to accept your amount. Then, you can monitor your payment progress.

Why DoorDash Capital?

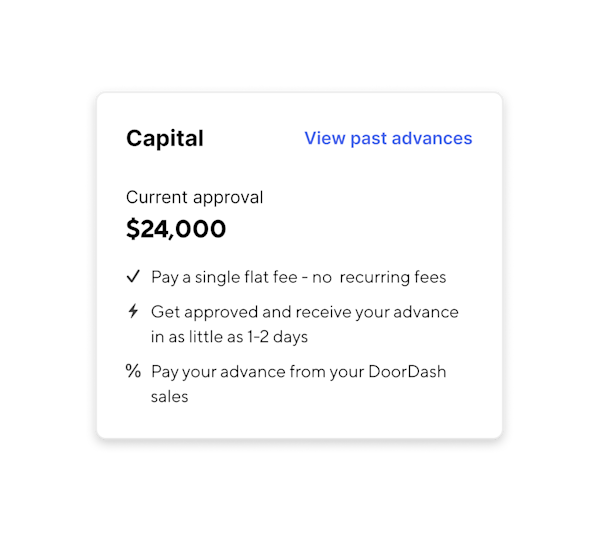

Fast and convenient funding

If you’re eligible*, you’ll see a pre-approved amount in your Merchant Portal. If you accept, you can receive the funds in as little as 1-2 days.

Transparent pricing

Pay a one-time flat fee and that’s it. Payment will be automatically deducted from your payout based on a percentage of your DoorDash sales.

Use the funds on business expenses

You determine how to use the capital — you can pay employees, cover unexpected expenses, upgrade equipment, and more.

Financing for merchants

Get easy access to capital (typically $5,000 to $15,000 or more) through a partnership between DoorDash and Parafin**, a business financing provider. There are no hidden charges, no recurring interest, and no prepayment penalty. The proposed financing is a cash advance, not a loan. There’s also no need to apply — eligible merchants can view, customize, and accept an offer in the Merchant Portal and receive funds in as little as 1-2 business days.

Hassle-free payment

Once an offer is accepted, your offer link becomes a payment dashboard where you can monitor your payment progress and make early payments if you’d like. Payments are taken as a percentage of your DoorDash sales.

"The flexibility that DoorDash Capital has provided us is really about helping us be stable with cash flow and weather some challenging times."

Brandon Gillis

Chef & Co-Owner, Fiorella

Read the storyFrequently asked questions

Eligibility is limited to select merchants and requires a sustained sales history with DoorDash. If you aren't eligible today, once you grow your DoorDash stores sales, you might become eligible in the future. Parafin is continuously re-evaluating which merchants qualify for the program based on sales performance on DoorDash.

Your cash advance will be paid with a fixed percentage of your sales. Sales-based repayments match your current sales payout schedule (daily, weekly, etc). You typically don’t have to initiate any payments yourself, it’s all automatic. Payments are either automatically debited from your designated bank account or deducted from your sales payouts until the balance is fully paid.

The total payment amount of your DoorDash Capital offer includes just two things: the amount of the offer and the one-time fee. No hidden fees at any time.

Payments are based on a fixed percentage of sales, so there is no fixed term.

No, DoorDash Capital doesn’t affect your credit score. There are no credit checks, and we don’t require a personal guarantee for your business to get an offer.

Parafin is a business financing provider focused on supporting small businesses. DoorDash has partnered with Parafin to offer funding to DoorDash merchants. All financing is governed by Parafin terms and conditions.

For questions regarding obtaining a new advance or a current advance, you’re welcome to reach out directly to our partner at doordash-capital@parafin.com.

For general inquiries, please reach out to capital@doordash.com.

* If you are eligible, you will see a pre-approved offer on the Capital tab in the Financials section.

** Merchant cash offers and advances are provided by Parafin and governed by Parafin’s Terms of Service. Merchant cash offers and advances and bank transfers are subject to review and may be rescinded. Merchant cash offers and advances are not extensions of credit or loans and they may not be used for personal, family, or household purposes.

Partner with DoorDash today

Learn how partnering with DoorDash can support your business growth.

Talk to our team